JUN

23

The shooting star candlestick pattern reflects the presence of selling pressure. The extended upper shadow signifies that sellers are actively participating and willing to sell at higher exchange rates. Such selling pressure suggests a potential shift in market sentiment towards bearishness. Forex traders interpret this as an opportunity to consider closing out longs, establishing short positions or at least tightening the stop-loss levels on existing long positions. When incorporating shooting star patterns into a trading strategy, risk management is crucial. Setting stop-loss orders above the high of the shooting star candlestick helps limit potential losses if price continues to rise instead of reversing as expected.

The shooting star candlestick pattern offers valuable insights to forex traders, providing indications of potential market reversals and bearish shifts in sentiment. When identified correctly, a shooting star candle can offer guidance on the future direction of the exchange rate. The shooting star reversal candlestick boasts a success rate of about 69% when predicting bearish reversals from an uptrend. However, the low success rate indicates it cannot be relied on its own to provide accurate reversal signals. Therefore, it is essential to use other indicators and candlestick formations to confirm whether a reversal is about to occur instead of basing all trading decisions on the single candlestick.

Shooting Star Pattern Candlestick Psychology

You should consider whether you can afford to take the high risk of losing your money. The Shooting Star formation is considered less bearish, but nevertheless bearish when the open and low are roughly the same. The Shooting formation is created when the open, low, and close are roughly the same price. If you are looking to trade forex online, you will need an account with a forex broker. If you are looking for some inspiration, please feel free to browse my best forex brokers. IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support.

- Also, consider using candlesticks in conjunction with other forms of analysis.

- It’s important to note that while shooting stars can be powerful reversal signals, they do have limitations.

- However, I will not recommend trading a candlestick pattern alone because a trading strategy consists of the confluence of many technical tools to increase the probability of winning.

- However, as the session or day progresses, short sellers enter the fray piling the pressure on the bulls.

- It appears at the end of an uptrend and suggests a potential downside reversal in the exchange rate.

The size of the wick with regard to the real body visually represents the failure of the Buyers and the success of the Bears or the Sellers. So the size of the wick is very important for validation of this candlestick pattern. The shooting star candle pattern appears on the top of an uptrend and indicates a potential reversal of the market trend. So traders should prepare to take a SELL position once this BEARISH pattern is identified.

What Does the Shooting Star Tell You?

It indicates that traders should be cautious about entering or holding onto long positions. In a bearish trend, the appearance of a shooting star can signal the end of a corrective bullish wave. Traders holding short positions may have been forced to exit and buy back their positions.

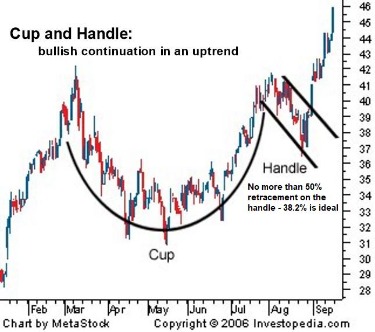

If you are interested in trading using technical analysis, have a look at our reviews of our recommended brokers to learn which tools they offer. For example, waiting a day to see if prices continued falling or other chart indications such as a break of an upward trendline. That will mean waiting for a bearish breakout event such as moving average crossover or range breakout. Shooting star patterns appear in the last two of these, and at the peak as the trend finally makes a top and reverses. However, it’s important to note that the Shooting Star indicator is not infallible. It requires careful interpretation and its subjective nature and potential limitations in different market conditions or timeframes should be taken into consideration.

The Psychology Behind The Pattern

The bullish version of the Shooting Star formation is the Inverted Hammer formation that occurs at bottoms. Looking at historical daily charts, we examined the five bars following every shooting star and obtained the following results. The appearance of a shooting star does not inevitably mean a bull trend is about to reverse. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Shooting Star: What It Means in Stock Trading, With an Example – Investopedia

Shooting Star: What It Means in Stock Trading, With an Example.

Posted: Sat, 25 Mar 2017 19:31:54 GMT [source]

In conclusion, the Shooting Star indicator can be a valuable tool for forex traders in identifying potential reversal signals in an uptrend. Its recognizable characteristics make it accessible to traders of various skill levels. When confirmed with proper risk management techniques, it can offer potential entry and exit points for short trades, allowing traders to manage their risk effectively. The shooting star pattern is a bearish reversal pattern, signaling a potential trend reversal from bullish to bearish. It suggests that the buying pressure has weakened, and sellers have started to gain control.

How to find a shooting star candlestick pattern?

In this article, we have explored the power of shooting star patterns in Forex trading and how they can be effectively incorporated into a trading strategy. By understanding what a shooting star pattern is, how to identify it, and the psychology behind it, traders shooting star forex pattern can gain valuable insights into market trends and potential reversals. Once you’ve identified shooting stars within the appropriate context, you can incorporate them into your trading strategy by using additional technical indicators or confirmation signals.

After a brief decline, the price could keep advancing in alignment with the longer-term uptrend. The long upper shadow represents the buyers who bought during the day but are now in a losing position because the price dropped back to the open. Price action trading with candlesticks gives a straightforward explanation of the subject by example. It includes data insights showing the performance of each candlestick strategy by market, and timeframe.

In this post, you’ll learn about the shooting star candlestick pattern’s structure, significance, trading psychology, and trading guide. When it comes to ascertaining bearish reversals, overbought conditions are of utmost importance. The shooting star pattern appearing as soon as the RSI moves above the 70 levels and into overbought territories should be a warning sign of potential price reversals.

However, it’s essential to remember that no strategy is foolproof, and there are limitations to relying solely on shooting stars for trade decisions. False signals do occur occasionally, which can lead to losses if not managed properly through risk management techniques like setting stop-loss orders or using proper position sizing methods. It is a single candlestick with a short body, a long shadow that points up and a small or non-existent lower shadow. The shape and position of the candlestick within a trend is more important than the body color. That is to say that the upper wick of this candle is very prominent in comparison to the lower wick. Additionally, the open and close of this formation occurs near the bottom of the range.

Is There A Bullish Shooting Star Pattern?

The shooting star candlestick also indicates a significant resistance level in the market. The long upper shadow represents a failed attempt by buyers to push an exchange rate higher. It suggests that the exchange rate encountered strong resistance at the upper level of the candle, causing selling pressure to emerge and overpower the buying pressure. This observation might lead a forex trader https://g-markets.net/ to anticipate a struggle for the market to sustain upward momentum that can potentially lead to a downside reversal or a period of consolidation. The shooting star candlestick is a crucial bearish pattern in technical analysis that forex traders frequently rely on to make trading decisions. It appears at the end of an uptrend and suggests a potential downside reversal in the exchange rate.